Tax incidence is:

A. the difference between what the buyers pay and what the sellers receive in a market where taxes are present.

B. the generated revenue that comes from taxes in markets.

C. the relative tax burden borne by buyers and sellers.

D. the difference between the tax revenue generated and the value of deadweight loss caused by the imposition of the tax.

Answer: C

You might also like to view...

The above figure shows the short-run production function for Albert's Pretzels. The average product of labor

A) increases first and then decreases. B) decreases first and then increases. C) decreases throughout. D) increases throughout.

The United States is the world's leading grain-producing nation. Exporting U.S. grain causes the

a. domestic consumption of grain to rise because of the added foreign demand. b. price of grain in the domestic market to fall because foreigners are now taking some of the domestic demand. c. price of grain to domestic consumers to rise because of the added foreign demand. d. standard of living of foreigners to fall because they lose purchasing power.

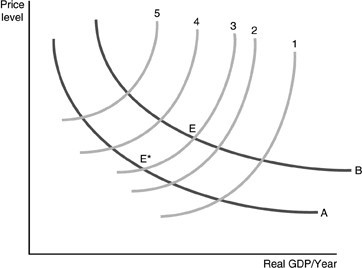

Refer to the above figure. Suppose the economy is at E originally, when the dollar increases in value. Which aggregate supply curve applies if the value of real GDP increases?

Refer to the above figure. Suppose the economy is at E originally, when the dollar increases in value. Which aggregate supply curve applies if the value of real GDP increases?

A. 1 B. 2 C. 4 D. 5

Price reflects the value households place on a good and marginal cost reflects the ________ of the resources needed to produce a good.

A. availability B. opportunity cost C. quantity D. productivity