Which of the following defenses by a surety will be effective to avoid liability?

a. Lack of consideration to support the surety undertaking.

b. Insolvency in the bankruptcy sense of the debtor.

c. Incompetency of the debtor to make the contract in question.

d. Fraudulent statements by the principal debtor that induced the surety to assume the obligation and that were unknown to the creditor.

.A

You might also like to view...

A disadvantage of focus groups is that the unstructured nature of the responses makes coding, analysis, and interpretation difficult

Indicate whether the statement is true or false

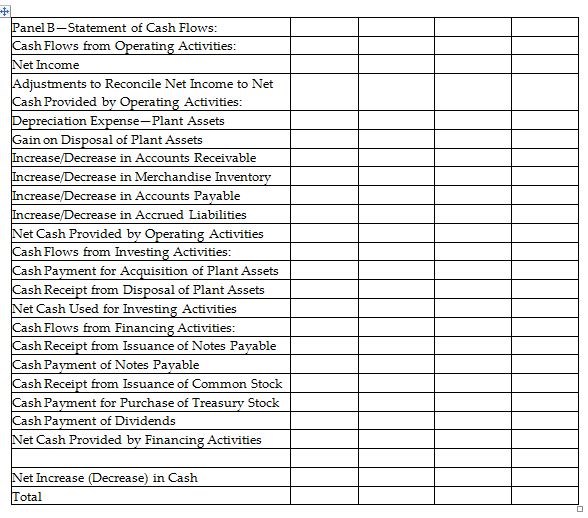

Redbird Company uses the indirect method to prepare its statement of cash flows. Using the following information, complete the worksheet for the year ended December 31, 2018.

- Net Income for the year ended December 31, 2018 was $49,000

- Depreciation expense for 2018 was $12,000

- During 2018, plant assets with a book value of $10,000 (cost $10,000 and accumulated depreciation $0) were sold for $14,000

- Plant assets were acquired for $52,000 cash

- Issued common stock for $28,000

- Issued long-term notes payable for $34,000

- Repaid long-term notes payable for $40,000

- Purchased treasury stock for 3,000

- Paid dividends of $10,000

_____ is the basis for the practice of reporting certain assets at the lower of acquisition cost or fair value. The requirement to test assets for impairment and to record impairment charges rests on the notion that balance sheet carrying values of assets should not exceed the amount of cash that the firm expects to receive by using or selling the asset

a. Conservatism b. Reliability c. Relevance d. Recognition e. Realization

What is their current savings ratio?

George and Betty, a middle-aged couple, have watched their savings account dwindle over the years. They both make good incomes and can't understand why they aren't saving more each month. Below is their financial information to complete an income statement. Gross monthly income: $8,000 Income taxes withheld monthly: $2,300 Monthly interest income from investments: $100 Monthly insurance payments: $700 Monthly housing expenses: $4,500 Monthly food expenses: $800 Miscellaneous expenses: $400 A) 10.3 percent B) negative 10.3 percent C) zero D) None of the above