In the Gordon growth model, a decrease in the required rate of return on equity

A) increases the current stock price.

B) increases the future stock price.

C) reduces the future stock price.

D) reduces the current stock price.

A

You might also like to view...

Firm A and Firm B emit 300 tons of pollution each and each have marketable permits that allow each to emit 100 tons of pollution

If it costs $5,000 for Firm A to eliminate 100 tons of pollution and it costs Firm B $6,000 to eliminate 100 tons of pollution, then A) Firm B sells its permits to Firm A for a price above $6,000. B) Firm A sells its permits to Firm B for a price below $6,000. C) Firm A sells its permits to Firm B for a price above $6,000. D) Firm B sells its permits to Firm A for a price below $6,000. E) Neither Firm A nor Firm B sells permits because neither has extra permits.

Economic variables that generally turn down before a recession begins and turn back up before the recovery starts are called:

A) leading indicators. B) coincident indicators. C) lagging indicators. D) none of the above.

The effect on the IS curve of a reduction in taxes will be less the

A) flatter is the LM curve. B) steeper is the LM curve. C) greater the extent of "crowding out." D) greater is the marginal propensity to save.

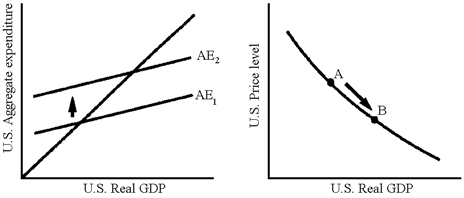

Figure 36-2

A. An increase in U.S. imports B. A decrease in U.S. exports C. An increase in U.S. exports D. A decrease in U.S. net exports