What would likely happen to the long-run aggregate supply curve if the U.S. federal government decreases marginal tax rates on wages?

A. The LRAS curve would shift leftward.

B. The LRAS curve would remain stable while the AD curve would shift leftward.

C. The LRAS curve would shift rightward.

D. The LRAS curve would remain stable while the AD curve would shift rightward.

Answer: C

You might also like to view...

What was the goal of Operation Twist?

A) to reduce long-term interest rates and increase short-term interest rates B) to reduce short-term interest rates and increase long-term interest rates C) to reduce both short-term and long-term interest rates D) to increase both short-term and long-term interest rates

Capital Funding

What will be an ideal response?

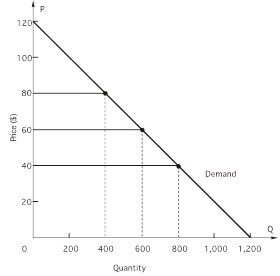

In the figure above, what is the point price elasticity of demand when price is $40?

In the figure above, what is the point price elasticity of demand when price is $40?

A. -1.50 B. -0.50 C. -1.00 D. -0.75 E. -2.00

A government sometimes creates an excess supply of a product by setting a minimum price at which the product may be sold to consumers. This is sometimes called a:

A. price ceiling. B. price floor. C. tax. D. subsidy.