If a country with a fixed exchange rate is continuously losing foreign reserves, speculators will

A. speculate that the country's currency will be revalued.

B. buy the country's currency and sell foreign currency.

C. sell the country's currency and buy foreign currency.

D. lend foreign currency to the country's central bank.

Answer: C

You might also like to view...

During a recession

A) incomes rise and employment decreases. B) incomes fall and unemployment increases. C) incomes fall and unemployment falls. D) incomes rise and unemployment increases.

Another benefit from entering a currency union that is not optimal would include:

A) the idea that economies interconnected in a currency union with increased trade also develop a symmetry of demand shocks. B) the reduction of interdependence and an increase in self-sufficiency. C) the cessation of disagreement over trade protection. D) the possibility of increasing the currency area.

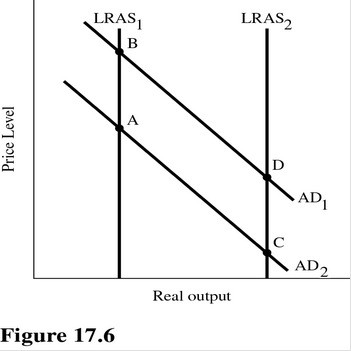

A shift from LRAS1 to LRAS2 in Figure 17.6 indicates that

A shift from LRAS1 to LRAS2 in Figure 17.6 indicates that

A. The price level has increased. B. The capacity of the economy has increased. C. LRAS has decreased. D. Aggregate demand has decreased.

The major difference between the Keynesian model and the classical theory of employment is that

A. the interest rate will not always equalize savings and investment. B. not everything produced will necessarily be purchased. C. saving and investing are done by different people for different reasons. D. wages and prices are assumed to be flexible downwards.