With a reserve ratio of 10 percent, the maximum potential money multiplier is

A) 1.

B) 5.

C) 10.

D) 100.

Answer: C) 10.

You might also like to view...

The stronger that consumer demand is for a good or service, other things being equal,

a. the higher its price. b. the lower its price. c. the more stable its price. d. the less stable its price.

Given the level of real GDP, the equilibrium level of the interest rate depends on the

A) demand for money. B) monetary-fiscal policy mix. C) size of the multiplier. D) extent of crowding out.

In the 1850s, the growth rate of real wages in U.S. manufacturing slowed to nearly zero because

a. the demand for manufacturing labor and the supply of manufacturing labor increased by approximately the same amount during this period. b. the demand for manufacturing labor and the supply of manufacturing labor decreased by approximately the same amount during this period. c. the demand for manufacturing labor increased more rapidly than the supply of manufacturing labor during this period. d. the demand for manufacturing labor increased while the supply of manufacturing labor decreased during this period.

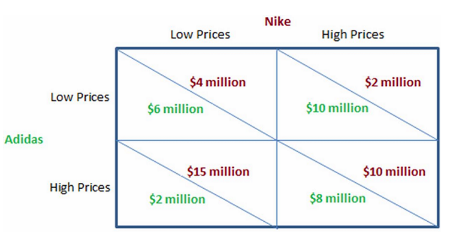

If Nike and Adidas are faced with the game in the figure shown, we can predict:

A. an outcome that is good for society and less than ideal for the companies.

B. an outcome that is less than ideal for society, but optimal for the companies.

C. that both will follow their dominant strategy and society will lose.

D. None of these is likely to happen.