From 1900 to 2013 real GDP per person in the U.S. has ________

A) doubled

B) grown by a factor of four

C) grown by a factor of nine

D) grown by a factor of twenty

E) declined

C

You might also like to view...

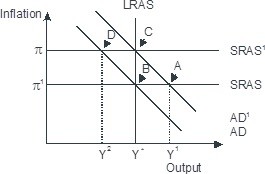

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

What are the three types of financial institutions that accept deposits that are part of the U.S. money supply? Briefly describe each of the three types of financial institutions

What will be an ideal response?

This table shows the total costs for various levels of output for a firm operating in a perfectly competitive market.PriceQuantityTC$500$10.00$501$20.00$502$27.50$503$77.50$504$147.50$505$250.00According to the table shown, what is the market price?

A. $50 B. $500 C. $27.50 D. $150

When a country is on the downward-sloping side of the Laffer curves, a cut in the tax rate will

a. decrease tax revenue and decrease the deadweight loss. b. decrease tax revenue and increase the deadweight loss. c. increase tax revenue and decrease the deadweight loss. d. increase tax revenue and increase the deadweight loss.