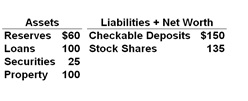

Answer the question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars:

Refer to the above data. If the commercial banking system actually loans out the maximum amount it is able to lend, excess reserves will fall:

A. By $28 billion

B. By $22 billion

C. By $20 billion

D. To zero

D. To zero

You might also like to view...

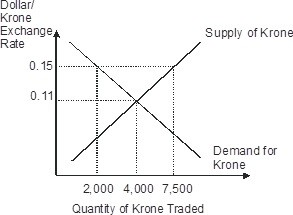

Based on this figure, if the official value of krone is fixed at $0.09 per krone, then the Norwegian krone is ________ and the international reserves of Norway will ________ krone per period.

A. overvalued; decrease by 5,500 B. undervalued; increase by 2,000 C. undervalued; increase by 5,500 D. overvalued; decrease by 2,000

The net amount of international reserves that move between governments to finance international transactions is called the ________ balance

A) capital account B) current account C) trade D) official reserve transactions

In the long-run ISLM model and with everything else held constant, an increase in the money supply leaves the level of output and interest rates unchanged, an outcome called

A) interest rate overshooting. B) long-run money neutrality. C) long-run crowding out. D) the long-run Phillips curve.

Economic analysis is used

A) only in economics classrooms. B) only by business people. C) only by policy makers. D) in all decision making.