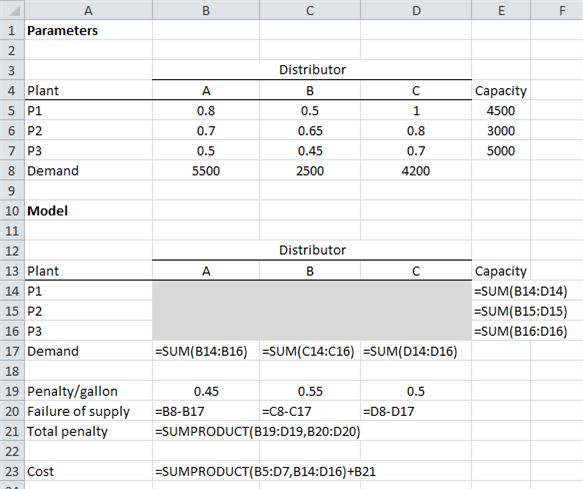

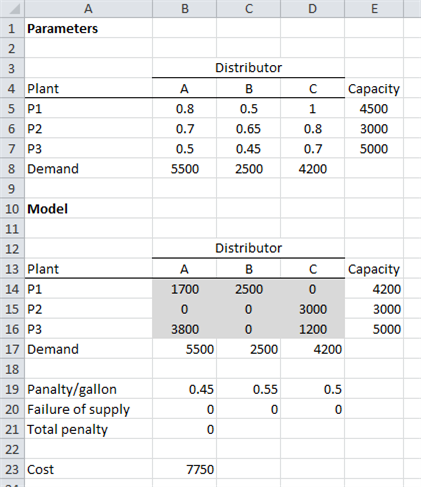

Three plants-P1, P2, and P3-of a gas corporation supply gasoline to three of their distributors located in the city at three different locations-A, B, and C. The plants' daily capacities are 4500, 3000, and 5000, gallons, respectively, while the distributors' daily requirements are 5500, 2500, and 4200 gallons. The per-gallon transportation costs (in $) are provided in the table below.

?

Distributor

Plant

A

B

C

P1

0.8

0.5

1

P2

0.7

0.65

0.8

P3

0.5

0.45

0.7

?

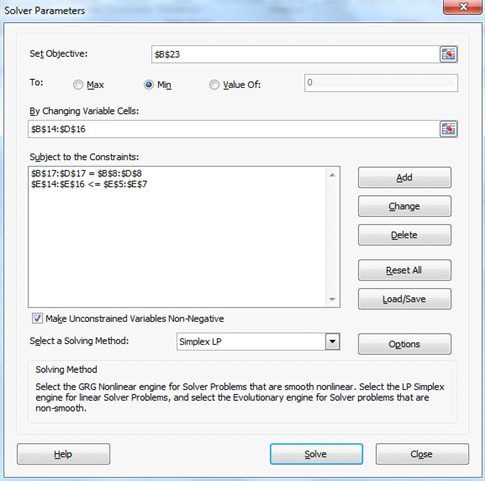

Because of a failure of expected supply earlier, the distributors A, B, and C have decided to charge a penalty this time of $0.45, $0.55, and $0.5 per gallon, respectively, to avoid any further delays.Now, determine the optimum supply of gasoline to the distributors in order to minimize the total transportation cost as well as the charges payable as penalty.

What will be an ideal response?

x12: number of gallons of gasoline supplied from Plant 1 to Distributor B

.

.

.

x33: number of gallons of gasoline supplied from Plant 3 to Distributor C

?

Min 0.8x11 + 0.5x12 + 1x13 + 0.7x21 + 0.65x22 + 0.8x23 + 0.5x31 + 0.45x32 + 0.7x33

s.t.

x11 + x12 + x13? 4,500

x21 + x22 + x23? 3,000

x31 + x32 + x33? 5,000

x11 + x21 + x31 = 5,500

x12 + x22 + x32 = 2,500

x13 + x23 + x33 = 4,200

x11, x12, …, x33? 0

?

You might also like to view...

A recordable case is any occupational death, illness, or injury to be recorded in

A. OSHA Form 300. B. Labor Department Industrial Census. C. HR Annual Report. D. NIOSH Form 4000.

On an amortization schedule, more interest and less principal is paid each month as the loan matures

Indicate whether the statement is true or false.

Sorting on multiple columns in Microsoft Access query design grid involves which of the

following? A) Placing the fields in order in which they should be sorted B) Checking the boxes on fields that should be shown C) Choosing the type of sort (Ascending, Descending) D) All of the above

Would a company be more likely to report a contingent liability under U.S. GAAP or IFRS?

A. Equally likely. B. U.S. GAAP. C. Contingent liabilities are not reported under IFRS. D. IFRS.