Assume that the government increases spending and finances the expenditures by borrowing in the domestic capital markets. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the GDP Price Index and current international transactions in the context of the Three-Sector-Model?

a. The GDP Price Index falls, and current international transactions become more negative (or less positive).

b. The GDP Price Index rises, and current international transactions become more negative (or less positive).

c. The GDP Price Index and current international transactions remain the same.

d. The GDP Price Index rises, and current international transactions remains the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.B

You might also like to view...

Suppose that the opportunity cost of producing goods differs between two nations. We can correctly state that

A) the two nations should not specialize in the production of goods. B) specialization can lead to an increase in the production of all goods. C) specialization can lead to an increase in the consumption of all goods. D) neither country has a comparative advantage in the production of any good.

As the wage rate increases, the substitution effect causes workers to supply more time to market work and the income effect causes them to supply less time to market work

a. True b. False

The worst and most difficult to extract resources are used first.

Answer the following statement true (T) or false (F)

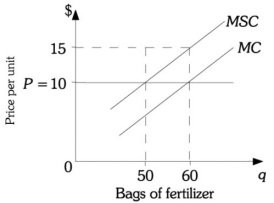

Refer to the information provided in Figure 16.1 below to answer the question(s) that follow.  Figure 16.1 Refer to Figure 16.1. The ________ imposed as a result of producing the efficient level of fertilizer is $250.

Figure 16.1 Refer to Figure 16.1. The ________ imposed as a result of producing the efficient level of fertilizer is $250.

A. marginal private cost B. tax C. total damage D. marginal social cost