Refer to Scenario 9.8 below to answer the question(s) that follow. SCENARIO 9.8: Investors put up $1,040,000 to construct a building and purchase all equipment for a new gourmet cupcake bakery. The investors expect to earn a minimum return of 10 per cent on their investment. The bakery is open 52 weeks per year and sells 900 cupcakes per week. The fixed costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10% return to the investors and $2,000 in other fixed costs. Variable costs include $2,000 in weekly wages, and $600 per week in materials, electricity, etc. The bakery charges $8 on average per cupcake.Refer to Scenario 9.8. Total revenue per week is

A. $6,000.

B. $7,200.

C. $8,100.

D. $9,500.

Answer: B

You might also like to view...

Optimal decisions are made at the point where marginal cost equals zero

Indicate whether the statement is true or false

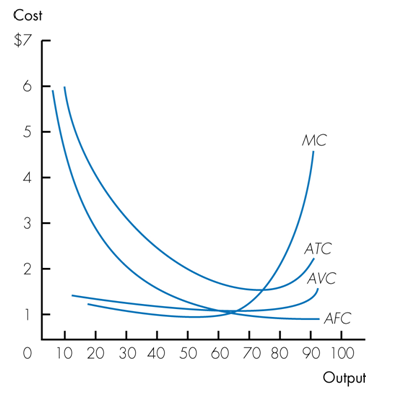

Refer to the following graph. Which of the following statements is true?

a. The vertical difference between the ATC curve and the AVC curve at any output level equals AFC.

b. Total fixed cost at any output level equals the difference between ATC and AVC.

c. Whenever the MC curve lies below the ATC or AVC curves then ATC and AVC are rising.

d. The AFC curves slopes downward for as long as MC is falling but rises when MC rises.

The growth rate in potential GDP is equal to the growth rate in the population

a. True b. False Indicate whether the statement is true or false

Keynes argued that when the economy is in a slump, an extra dollar of savings by households will:

A. translate into highly risky investment spending by firms. B. translate into an additional dollar of investment spending by firms. C. not necessarily translate into an additional dollar of investment spending by firms. D. translate into more than an additional dollar of investment spending by firms.