If a stock's dividend is expected to grow at a constant rate of 4 percent in the future and it has just paid a dividend of $6.00 per share,

and you have an alternative investment of equal risk that will earn a 7 percent rate of return, what would you be willing to pay per share for this stock?

A) $6.66 B) $54.55 C) $200.00 D) $208.00

D

You might also like to view...

If the nominal interest rate in an economy is 9% and the expected inflation rate is 6%, then the expected real interest rate in the economy is:

A) 15%. B) 3%. C) 6%. D) 9%.

In 2012, consumers in Dexter consumed only books and pens. The prices and quantities for 2012 and 2013 are listed in the table above. The reference base period for Dexter's CPI is 2012. What is the CPI in 2013?

A) 59 B) 129 C) 169 D) 102

The U.S. government

A. intervenes to prevent the monopolization of any market. B. forbids the creation of legal impediments to entry into any market. C. intervenes to prevent the monopolization of some markets and actively encourages the monopolization of others. D. encourages the permanent monopolization of all markets in which the monopolist has technical superiority over potential competitors.

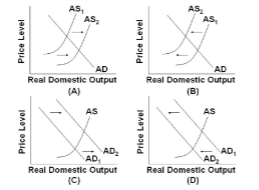

Which of the diagrams best portrays an improvement in expected rates of return on investment?

Use the following diagrams for the U.S. economy to answer the following question.

A. A.

B. B.

C. C.

D. D.