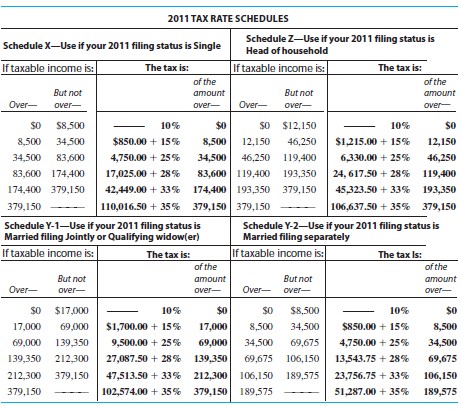

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  Megan Cortez had an adjusted gross income of $51,453 last year. She had deductions of $886 for state income tax, $570 for property tax, $3809 in mortgage interest, and $605 in contributions. Cortez claims one exemption and files as a single person.

Megan Cortez had an adjusted gross income of $51,453 last year. She had deductions of $886 for state income tax, $570 for property tax, $3809 in mortgage interest, and $605 in contributions. Cortez claims one exemption and files as a single person.

A. $7520.75

B. $6595.75

C. $8063.25

D. $8988.25

Answer: B

Mathematics

You might also like to view...

Divide.(-30) ÷ (-6)

A. -5 B. -6 C. 5 D. 6

Mathematics

Using a graphing calculator to graph f and g in the window [0, 6, 1] by [0, 6, 1]. Which function is greater when  ?f(x) = x2.8, g(x) = x-2.8

?f(x) = x2.8, g(x) = x-2.8

A. g(x) B. f(x)

Mathematics

Use a graphing utility to find the sum of the geometric sequence. Round answer to two decimal places, if necessary.4 + 12 + 36 + 108 + 324 + ... + 4 ? 37

A. 13,100 B. 13,120 C. 13,122 D. 13,157

Mathematics

Reduce the rational expression to lowest terms.

A.

B.

C.

D.

Mathematics