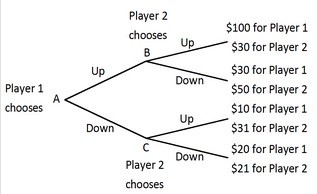

Player 1 and Player 2 are playing a game in which Player 1 has the first move at A in the decision tree shown below. Once Player 1 has chosen either Up or Down, Player 2, who can see what Player 1 has chosen, must choose Up or Down at B or C. Both players know the payoffs at the end of each branch. Suppose Player 1 and Player 2 enter into a binding agreement in which Player 1 agrees to pay Player 2 a fixed amount of money to get Player 2 to play Up when it is Player 2's turn. How much will Player 1 have to pay Player 2 to get Player 2 to play Up?

Suppose Player 1 and Player 2 enter into a binding agreement in which Player 1 agrees to pay Player 2 a fixed amount of money to get Player 2 to play Up when it is Player 2's turn. How much will Player 1 have to pay Player 2 to get Player 2 to play Up?

A. at least $20.

B. $0.

C. at least $10.

D. at least $50.

Answer: A

You might also like to view...

In a monopolistically competitive industry, the firms are currently making an economic profit. When this market moves to its long-run equilibrium, the firms' demand curves will have ________ and their economic profit will have ________

A) shifted leftward; decreased to zero B) shifted leftward; decreased but remain greater than zero C) shifted rightward; decreased to zero D) remained the same; decreased to zero

Either a cut in business taxes or an increase in real interest rates would increase investment and aggregate demand, other things equal

a. True b. False Indicate whether the statement is true or false

If you compared the short-run demand and long-run demand for education at your college, you would almost certainly find that

a. the long-run demand curve was steeper than the short-run demand curve. b. a tuition increase would reduce enrollment more in the long run than in the short run. c. a reduction in tuition would increase enrollment in the short run but not in the long run. d. the short-run and long-run demand curves were identical.

Investment in human capital has opportunity costs, but investment in physical capital does not

a. True b. False Indicate whether the statement is true or false