Table 14.1Monetary Aggregates of the U.S. Financial SystemItemAmountCash held by public$250 billionTransactions deposits$1,000 billionRequired reserves$150 billionExcess reserves$0 billionU.S. bonds held by public$1,000 billionAssume an original balance sheet: Refer to Table 14.1. If the Fed buys $10 billion in bonds from the public, all of the following are true except

A. The discount rate will rise.

B. Additional increases in M1 will occur after the multiplier process.

C. The public will still hold $990 billion worth of bonds.

D. M1 will increase initially by $10 billion.

Answer: A

You might also like to view...

If the Fed decides to buy bonds, the result will be

A) lower bond prices and higher interest rates. B) higher bond prices and higher interest rates. C) higher bond prices and lower interest rates. D) lower bond prices and lower interest rates.

Foreign exchange market intervention involves the purchase or sale of currencies by governments to influence the market exchange rate

Indicate whether the statement is true or false

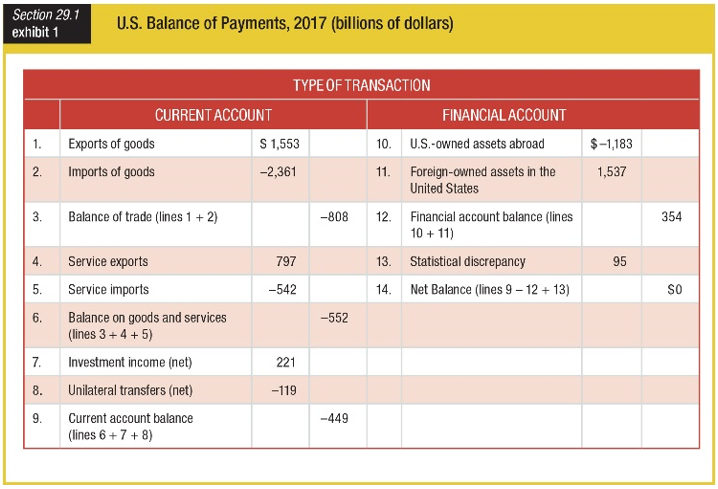

What was the financial account balance in 2017?

a. $1,537 billion

b. $354 billion

c. -$449 billion

d. -$1,183 billion

Arturo runs a Taco Bell franchise. He is selling 250 Gordita Supremes per week at a price of $2.75. If he lowers the price to $2.70, he will sell 251 Gordita Supremes. What is the marginal revenue of the 251st Gordita Supreme? If selling the extra

Gordita Supreme adds $0.20 to Arturo's costs, what will be the effect on his profit from selling 251 Gordita Supremes instead of 250? What will be an ideal response?