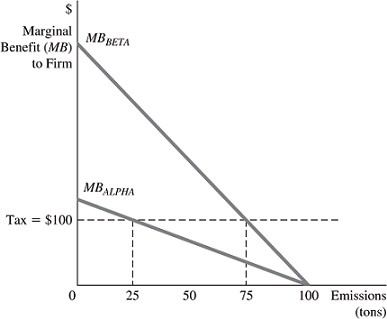

Refer to the information in Figure 16.5 below to answer the question(s) that follow. ?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. For Alpha, the tax is ________ than the marginal benefit it gets from polluting, and for Beta, the tax is ________

?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. For Alpha, the tax is ________ than the marginal benefit it gets from polluting, and for Beta, the tax is ________

than the marginal benefit it gets from polluting.

A. higher; lower

B. lower; higher

C. lower; lower

D. higher; higher

Answer: D

You might also like to view...

Refer to the Article Summary. The additional tax of $2 per pack of cigarettes being proposed by Senator Pan would have which of the following effects on the market for cigarettes in California?

A) Producer surplus will increase. B) Market efficiency will increase. C) Deadweight loss will decrease. D) Consumer surplus will decrease.

Which of the following is a correct statement about bond prices, other things equal?

a. a lower face value leads to a higher bond price b. a higher risk of default leads to a higher bond price c. a higher risk of default leads to a lower yield d. fewer coupon payments lead to a higher bond price e. a higher price leads to a lower yield

The law of diminishing marginal utility guarantees that demand curves will have positive slopes.

Answer the following statement true (T) or false (F)

The kinked demand curve model is based on the assumption that rival firms will match a price cut but ignore a price increase.

Answer the following statement true (T) or false (F)