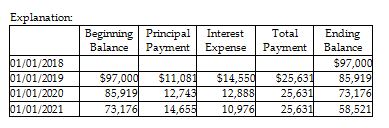

On January 1, 2018, Brazos Company purchased equipment and signed a six-year mortgage note for $97,000 at 15%. The note will be paid in equal annual installments of $25,631, beginning January 1, 2019. On January 1, 2019, the journal entry to record the first installment payment will include a ________.

(Round your answer to the nearest whole number.)

A) debit to Mortgage Payable for $25,631

B) debit to Interest Expense for $14,550

C) credit to Cash for $11,081

D) credit to Mortgage Payable for $97,000

B) debit to Interest Expense for $14,550

You might also like to view...

Oreo Company has current assets of $20,000, current liabilities of $8,000, and long-term liabilities of $3,000 . Oreo wants to buy new equipment. How much of its existing cash can Oreo use to acquire equipment without allowing its current ratio to decline below 2.0 to 1?

a. $ 4,000 b. $ 8,000 c. $ 10,000 d. $ 12,000

Goods held on consignment should be included in the consignee's ending inventory

Indicate whether the statement is true or false

Which of the following is generally considered an advantage of term loans over corporate bonds?

A. Higher flotation costs B. Speed, or how long it takes to bring the issue to the market C. Fixed bond terms after the bond has been issued D. Regular interest and principal payments on specified dates E. Standard terms of issue requiring no negotiation between the borrowing firm and the financial institution

Discounts related to price discrimination will be

A) volume based. B) unit based. C) marginally based. D) lot size based.