What effect would taxation have on real consumption spending when government spending is autonomous?

A. Taxation increases real consumption spending.

B. Taxation reduces real consumption spending.

C. Taxation causes both real consumption spending and planned real saving to increase.

D. None of these is correct.

Answer: B

You might also like to view...

Use the following data to answer the next question. The disposable income (DI) and consumption (C) schedules are for a private, closed economy (an economy with no government and no international trade). All figures are in billions of dollars.Disposable IncomeConsumption$300$310350340400370450400500430If disposable income is $550, we would expect consumption to be

A. $430. B. $460. C. $450. D. $470.

Suppose the required reserve ratio is 20 percent. If banks are conservative and choose not to loan all of their excess reserves, the real-world deposit multiplier is

A) less than 5. B) equal to 5. C) greater than 5. D) equal to 20.

The Japanese experience of the 1990s shows:

A. monetary policy is always more effective than fiscal policy. B. central bankers should not try to counter the business cycle. C. sometimes monetary policy does not work. D. monetary policy always works.

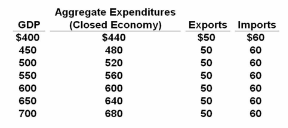

Refer to the above data. If this economy were closed to international trade, then the equilibrium GDP and the multiplier would be:

A. $500 billion and 5

B. $500 billion and 4

C. $600 billion and 5

D. $600 billion and 4