Suppose the market demand function for ice cream is Qd = 10 - 2P and the market supply function for ice cream is Qs = 4P - 2, both measured in millions of gallons of ice cream per year. Suppose the government imposes a $0.50 tax on each gallon of ice cream. The consumer surplus with the tax is:

A. $166,667.

B. $3.56 million.

C. $7.11 million.

D. $9 million.

C. $7.11 million.

You might also like to view...

An economy with an expansionary gap will, in the absence of stabilization policy, eventually experience a(n) ________ in the inflation rate, leading to a(n) ________ in output.

A. decrease; increase B. increase; increase C. decrease; decrease D. increase; decrease

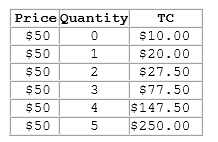

According to the table shown, what is the market price?

This table shows the total costs for various levels of output for a firm operating in a perfectly competitive market.

A. $500

B. $150

C. $50

D. $27.50

Which of the following is an example of an injection into the circular flow of income and expenditure?

a. Consumption b. Exports c. Taxes d. Saving e. Government borrowing

If a developing country has sufficient reserves, the buying and selling of foreign currency by the central bank is:

A. likely to have a much smaller impact on the exchange rate than in developed countries. B. completely ineffective on the exchange rate. C. likely to have a much greater impact on the exchange rate than in developed countries. D. likely to have roughly the same impact on the exchange rate as in developed countries.