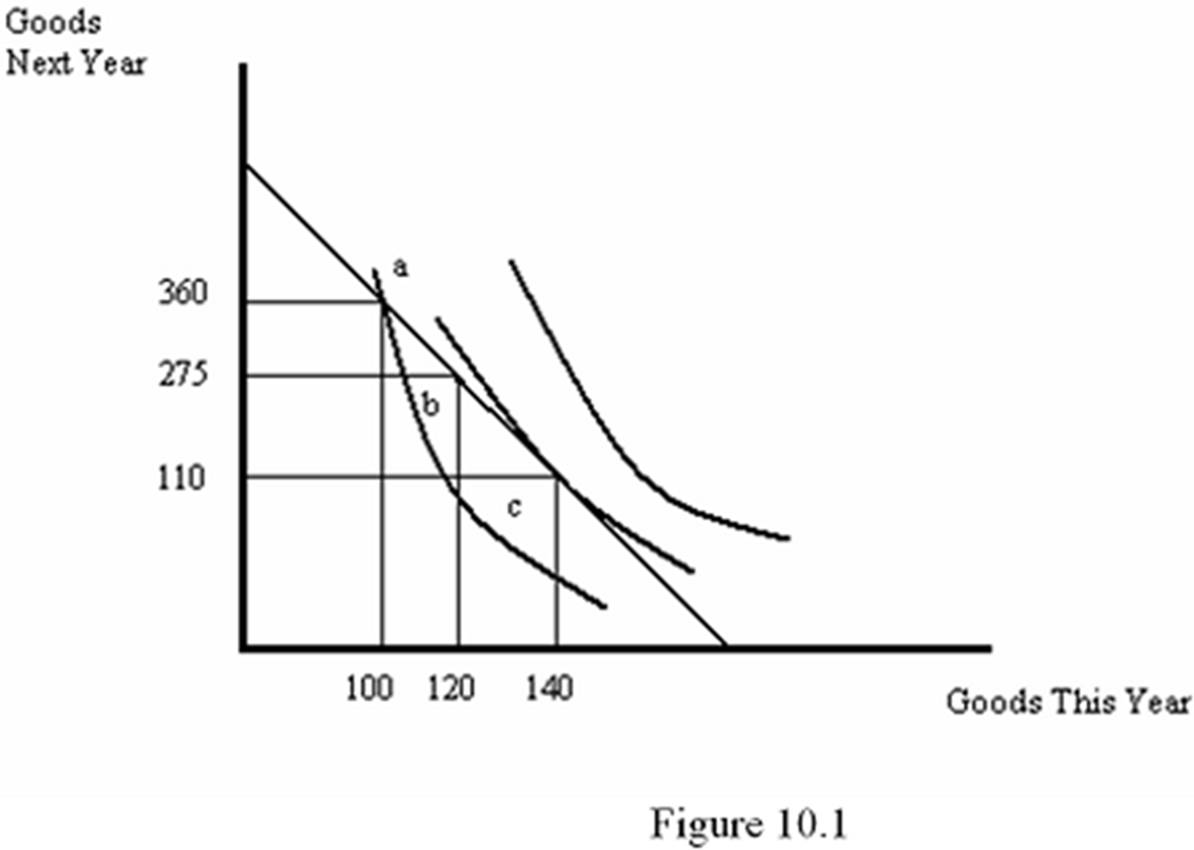

Refer to Figure 10.1. Suppose the individual is initially at point b. Based on the figure, the individual is currently:

}

A. a saver, which is his optimal choice.

B. a borrower, which is his optimal choice.

C. a saver, though borrowing would increase his utility.

D. a borrower, though saving would increase his utility.

C. a saver, though borrowing would increase his utility.

You might also like to view...

Which of the following is not a limitation of the Pareto criteria?

a. Almost any policy change will make at least one person worse off. b. The status quo is lent legitimacy from being the starting point for evaluating social welfare. c. The criteria cannot tell us if a particular policy change will make all participants better off. d. The criteria do not allow for the ranking of all possible states of the world.

If the demand faced by a firm is inelastic, selling one more unit of output will

a. increase revenues. b. decrease revenues. c. keep revenues constant. d. increase profits.

The welfare loss created by monopolistically competitive markets:

A. is a hotly debated topic among economists. B. is a huge concern to governments. C. has a widely accepted form of measurement. D. is usually not a huge concern to governments.

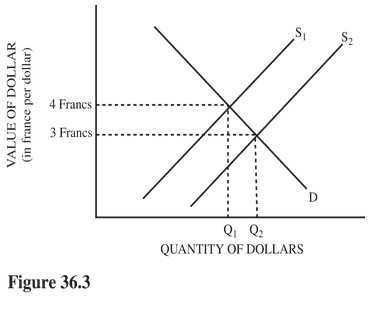

Refer to Figure 36.3 for the dollar-Swiss franc foreign exchange market. Which of the following is true?

Refer to Figure 36.3 for the dollar-Swiss franc foreign exchange market. Which of the following is true?

A. An increase in supply from S1 to S2 could be caused by an increase in Swiss demand for U.S. corn. B. An increase in supply from S1 to S2 could be caused by an increase in the U.S. demand for Swiss chocolate. C. The Swiss franc appreciates in value compared to the U.S. dollar when supply decreases from S2 to S1. D. The U.S. dollar appreciates in value compared to the franc when supply increases from S1 to S2.