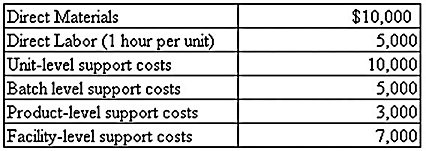

The management accountant at Morrison, Inc. provided the following estimated costs for producing 2,500 units of a specialty product manufactured by the firm: The company believes that direct labor hours are the most appropriate cost driver for assigning overhead costs to its product.Required:1) Compute the predetermined overhead rate for this company.2) Compute the specialty product's total estimated cost per unit.3) Why do firms assign overhead costs using a predetermined overhead rate instead of assigning actual costs?

The company believes that direct labor hours are the most appropriate cost driver for assigning overhead costs to its product.Required:1) Compute the predetermined overhead rate for this company.2) Compute the specialty product's total estimated cost per unit.3) Why do firms assign overhead costs using a predetermined overhead rate instead of assigning actual costs?

What will be an ideal response?

1) Predetermined overhead rate:

Total overhead = $10,000 + $5,000 + $3,000 + $7,000 = $25,000;

Predetermined rate = $25,000 ÷ 2,500 = $10.00 per direct labor hour

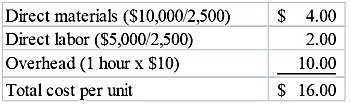

2) Cost per unit:

3) Using a predetermined rate allows management to determine the cost of the product in a more timely manner. In addition, it smoothes out or annualizes overhead costs so that unit costs are more stable.

You might also like to view...

Realized capital gains are

A. increases in the value of a firm that occur because a firm has retained earnings that are exempt from corporate profits taxes. B. capital gains that are owned by foreigners. C. capital gains that an investor receives from actually selling stock. D. capital gains that have been accrued but not yet received because the stock has not been sold.

The Sarbanes-Oxley Act of 2002 requires that a company’s chief executive officer and chief financial officer must comply with which of the following?

a. Open personal lines of credit. b. Hire an ethics officer. c. Set procedures and guidelines for the board of directors. d. Hire a diversity officer. e. Personally certify financial reports.

At the unconscious need level, people do not know why they buy a product-only that they do buy.

Answer the following statement true (T) or false (F)

Which statement is true?

a. The allowance method uses an estimate based on (1) a percent of sales or (2) an analysis of receivables. b. Direct write-off is best suited for large companies and those with a large amount of receivables. c. The direct write-off method uses an allowance account. d. Adjusting entries are necessary under both the direct write-off and the allowance methods.