Discuss whether the standard deviation of a portfolio is, or is not, a weighted average of the standard deviations

of the assets in the portfolio. Fully explain your answer.

What will be an ideal response?

The standard deviation of a portfolio is not a weighted average of the standard deviations of the assets in the portfolio.

If the portfolio is well-diversified then it should have a standard deviation that is lower than most or all of the assets

placed in that portfolio. Betas can be averaged, but standard deviations cannot, due to the diversifiable risk that is

contained in the standard deviation but not reflected by beta.

You might also like to view...

The first step in understanding how to manage the guest experience is ______.

a. defining the service product b. organizing the top management team c. hiring the right people d. understanding the guests in the target market

Which of the following statements best describes the balance in a revenue account at the beginning of an accounting period?

A. Higher than the previous period's beginning balance B. Equal to the amount of retained earnings for the previous period C. Zero D. Last period's ending balance

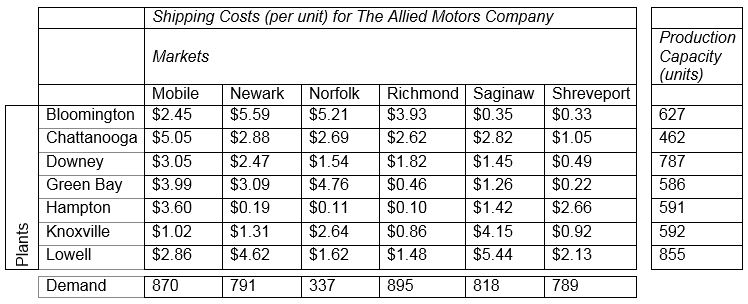

Refer to the Shipping Costs for The Allied Motors Company. Solve the transportation problem using Excel Solver. (Remember that in balanced transportation problems all constraints--except the nonnegativity constraints of the decision variables--should be set as an equal to (=) sign in the Excel Solver dialogue.) At the optimum solution, the cost of shipping from Green Bay to Richmond is ______.

A. $893

B. $270

C. $672

D. $576

A tenancy at sufferance describes a tenancy that can be terminated at any time upon proper notice

Indicate whether the statement is true or false