Answer the following statement(s) true (T) or false (F)

1. Small, medium, and large taxes all affect deadweight loss equally.

2. A large increase in tax can reduce the quantity exchanged to the point where there is very little tax revenue raised.

3. Subsidies create welfare gains.

4. Price ceilings create deadweight losses.

5. Deficiency payment programs are designed to help poor teachers.

1. False

2. True

3. False

4. True

5. False

You might also like to view...

The costs of a recession are largely

A) losses to some people but gains to others. B) made up in the subsequent recovery. C) the consequences of falling prices. D) the costs of disappointed expectations. E) welcomed by advocates of zero economic growth.

Which of the following provides a tool by which you can measure overall price changes paid by representative individuals living in urban households?

(a) The GDP Deflator ( NGDP/RGDP 100, expressed as a percentage ) (b) The Producer Price Index (c) The Consumer Price Index (d) The Housing Price Index

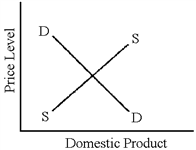

Figure 5-2

?

A. an outward shift in the aggregate supply curve and an increase in the price level. B. an outward shift in the aggregate demand curve and an increase in the price level. C. an inward shift of the aggregate demand curve and an increase in the price level. D. an inward shift of the aggregate demand curve and a decrease in the price level.

When an economy is operating at its full employment rate of output:

A. the rate of unemployment will be zero. B. output will exceed the economy's maximum sustainable rate. C. the actual rate of unemployment will equal the natural rate. D. the economy's potential rate of output will exceed actual GDP.