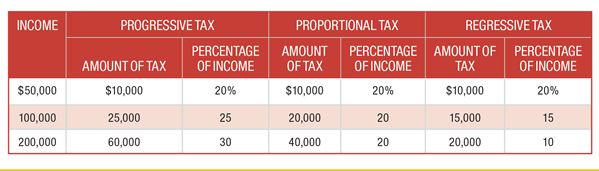

Joe earns $50,000 per year, Brian earns $100,000 per year, and Pammy earns $200,000 per year. Based on the table demonstrating three tax systems, who is likely to be the most concerned about which tax system is used as it applies to take home pay?

a. Joe and Brian

b. Joe

c. Brian

d. Pammy

d. Pammy

You might also like to view...

Suppose Ariana deposits $75,000 in her bank. If the reserve ratio is 20 percent, this will lead to a maximum increase of ________ in checking account balances throughout all banks

A) $15,000 B) $375,000 C) $750,000 D) $1,500,000

Assume that for whatever reason there is a manufacturing firm exhibits a constant marginal product of labor over a certain range of production

Armed with only this information what would you be able to say about the average product and total product of labor curves of this firm.

Refer to Table 4-7. If a minimum wage of $12.50 an hour is mandated, what is the quantity of labor supplied?

A) 80,000 B) 550,000 C) 630,000 D) 1,180,000

Pay-as-you-go social security

A) can never improve economic welfare for everyone. B) can improve welfare for everyone if the population growth rate is large enough. C) is always inefficient. D) is not used by any countries in the world.