The total excess return on the Razorback Fund's managed portfolio was

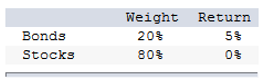

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

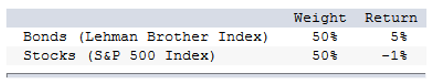

The return on a bogey portfolio was 2%, calculated from the following information.

A. -1.80%.

B. -1.00%.

C. 0.80%.

D. 1.00%.

B. -1.00%.

1% 2% = 1%.

You might also like to view...

Which type of organizational structure is ideally placed to meet external demands, however groups that are performing similar tasks may be at risk of duplicating their work and they may also compete for shared resources?

a. Matrix b. Functional c. Divisional d. Simple

What problem did FedEx solve for customers in its CVP?

a. the lack of easy, door-to-door, overnight delivery of packages b. the lack of customer signatures of received goods c. the lack of alternatives to the USPS d. the lack of prepackaged envelopes or-to-door, overnight delivery of packages

Assume you are to receive a 10-year annuity with annual payments of $1000. The first payment

will be received at the end of Year 1, and the last payment will be received at the end of Year 10. You will invest each payment in an account that pays 9 percent compounded annually. Although the annuity payments stop at the end of year 10, you will not withdraw any money from the account until 25 years from today, and the account will continue to earn 9% for the entire 25-year period. What will be the value in your account at the end of Year 25 (rounded to the nearest dollar)? A) $48,359 B) $55,340 C) $35,967 D) $48,000

Whereas the maximization primal model has ? constraints, the ________ dual model has ? constraints

Fill in the blank with correct word.