Refer to Scenario 19.1 below to answer the question(s) that follow. SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%. Refer to Scenario 19.1. Suppose this person earns $70,000 and gives a $1,000 tax deductible donation to charity. The donation reduces her tax payment by

A. $200.

B. $207.

C. $250.

D. $1000.

Answer: C

You might also like to view...

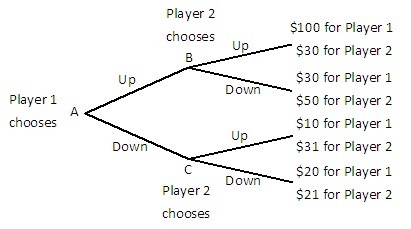

Player 1 and Player 2 are playing a game in which Player 1 has the first move at A in the decision tree shown below. Once Player 1 has chosen either Up or Down, Player 2, who can see what Player 1 has chosen, must choose Up or Down at B or C. Both players know the payoffs at the end of each branch.  What is the equilibrium outcome of this game?

What is the equilibrium outcome of this game?

A. Player 1 chooses Up and Player 2 chooses Down. B. Player 1 chooses Down and Player 2 chooses Up. C. Player 1 and Player 2 both choose Down. D. Player 1 and Player 2 both choose Up.

In the above figure, if income is $8, the initial price of a soft drink is $1, and the initial price of a milkshake is $2, a decrease in the price of a milkshake to $1 will move the consumer from point ________ to point ________

A) a; b B) b; c C) a; d D) a; c

In what sense is it a cost that people must spend time and resources coping with inflation?

a. Because the loss of time and resources frustrates people unnecessarily b. Because the time and resources could have been used to produce something else instead c. Because the time and resources could have been wasted elsewhere d. Because the time and resources are a sunk cost e. Because the time and resources are insufficient to cope with the problem

The number of unskilled workers employed before and after an increase in the minimum wage is found to be the same. This means