Jenny took out a loan of $27,000 from All Union Bank. She deposited the amount in her savings account in Smith and Kim Bank. In the given scenario, which of the following statements is true?

a. $27,000 will be an asset for Smith and Kim Bank, while $27,000 will be a liability for All Union Bank.

b. $27,000 will be a liability for Smith and Kim Bank, while $27,000 will be an asset for All Union

Bank.

c. $27,000 will be an asset for both Smith and Kim Bank and All Union Bank.

d. $27,000 will be a liability for both Smith and Kim Bank and All Union Bank.

b

You might also like to view...

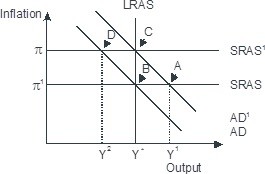

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

A perfectly competitive firm maximizes profits? (or minimize? losses) when it produces the quantity where marginal revenue equals marginal cost and the price? is:

A. greater than average fixed cost. B. greater than average variable cost. C. greater than average total cost. D. greater than marginal cost

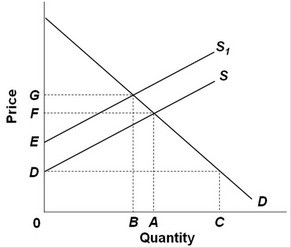

Refer to the above supply and demand graph. In the graph, point A is the current equilibrium level of output of this product and point B is the optimal level of output from society's perspective. S is the supply curve without a tax and St is the supply curve with a tax. One solution to this externality problem is to:

Refer to the above supply and demand graph. In the graph, point A is the current equilibrium level of output of this product and point B is the optimal level of output from society's perspective. S is the supply curve without a tax and St is the supply curve with a tax. One solution to this externality problem is to:

A. tax producers by the amount DE. B. give producers a subsidy of the amount AB. C. give consumers a subsidy of the amount FG. D. tax consumers by the amount EF.

Legalizing all forms of illegal activities

A) reduces GDP and reduces the size of the underground economy. B) reduces GDP and increases the size of the underground economy. C) increases GDP and reduces the size of the underground economy. D) increases GDP and increases the size of the underground economy.