Vore Corporation is considering a capital budgeting project that involves investing $570,000 in equipment that would have a useful life of 3 years and zero salvage value. The net annual operating cash inflow, which is the difference between the incremental sales revenue and incremental cash operating expenses, would be $280,000 per year. The project would require a one-time renovation expense of $60,000 at the end of year 2. The company uses straight-line depreciation and the depreciation expense on the equipment would be $190,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30%. The after-tax discount rate is 8%.Required:Determine the net present

value of the project. Show your work!

What will be an ideal response?

| Year |

| ? | Now | 1 | 2 | 3 |

| Calculate the annual tax expense: | ? | ? | ? | ? |

| Net annual op. cash inflow | ? | $280,000 | $280,000 | $280,000 |

| One-time expense | ? | ? | $(60,000) | ? |

| Depreciation expense | ? | $(190,000) | $(190,000) | $(190,000) |

| Incremental net income | ? | $90,000 | $30,000 | $90,000 |

| Tax rate | ? | 30% | 30% | 30% |

| Income tax expense | ? | $(27,000) | $(9,000) | $(27,000) |

| ? | ? | ? | ? | ? |

| Calculate the net present value: | ? | ? | ? | ? |

| Purchase of equipment | $(600,570) | ? | ? | ? |

| Net annual op. cash inflow | ? | $280,000 | $280,000 | $280,000 |

| One-time expense | ? | ? | $(60,000) | ? |

| Income tax expense | $(27,000) | $(9,000) | $(27,000) | |

| Total cash flows | $(570,000) | $253,000 | $211,000 | $253,000 |

| Discount factor (8%) | 1.000 | 0.926 | 0.857 | 0.794 |

| Present value of cash flows | $(570,000) | $234,278 | $180,827 | $200,882 |

| Net present value | $45,987 | ? | ? | ? |

You might also like to view...

A control designed to ensure that sales transactions are generated using the company's most current prices would be considered to be which type of control?

a. An input control. b. A processing control. c. An output control. d. A physical control.

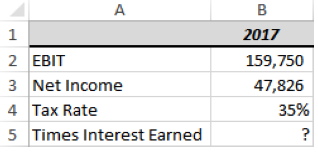

What should be the formula in B5?

a) =B2/(B2/(1-B4))

b) =B2/(B3/(1-B4))

c) =B2/(B2-B3/(1-B4))

d) =B2/B2-B3/1-B4

e) =(B2/B2)-B3/(1-B4)

In estimating the amount of uncollectible accounts the accountant (1) estimates the amount of uncollectible accounts that will likely occur over time in connection with sales of each period and (2) makes an entry debiting Bad Debt expense and crediting Allowance for Uncollectible Accounts. The name of this procedure is/are the

a. percentage-of-sales. b. aging-of-accounts-receivable. c. direct write-off. d. indirect write-off. e. tax accounting.

Although businesses prefer to deliver bad news to employees personally, when bad news must be given to large groups of employees, businesses are most likely to use which of the following?

A) Newspaper advertisements B) Hard-copy memos C) Tweets D) Wikis