The reason for the different in tax policy and spending policy by the government is due to:

A. people not responding to tax policy as much as spending policy.

B. the fact that when the government engages in spending policy, they do it more aggressively.

C. firms drastically responding to tax changes that are implemented.

D. the difference in initial spending that results from engaging in tax policy.

D. the difference in initial spending that results from engaging in tax policy.

You might also like to view...

In the above figure, which movement illustrates the impact of the price level and money wage rate rising at the same rate?

A) E to H B) E to K C) E to G D) E to J

In the Keynesian model, if planned investment exceeds planned saving at full-employment output,

a. unemployment is likely to develop. b. government spending may be needed to balance the economy. c. inflation is likely to occur. d. None of these.

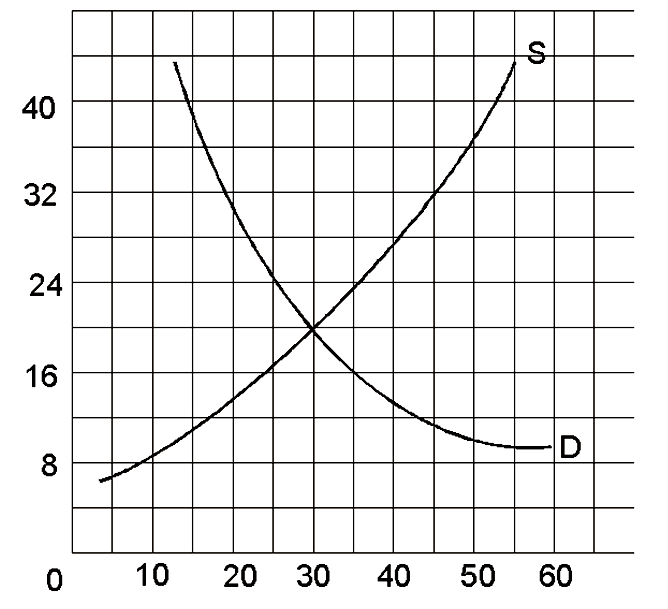

If the government set a price floor at $18

A. there would be a temporary surplus, then prices would fall to equilibrium.

B. the price floor would not have any effect on this market.

C. then quantity demanded would be greater than quantity supplied.

D. there would be a permanent surplus, at least until the price floor was lifted.

What effect does the increase of the price of gasoline have on the cost curves of package delivery firms such as Federal Express or United Parcel Service? How might the effects differ for a software firm such as Symantec that uses the Internet?

Please provide the best answer for the statement.