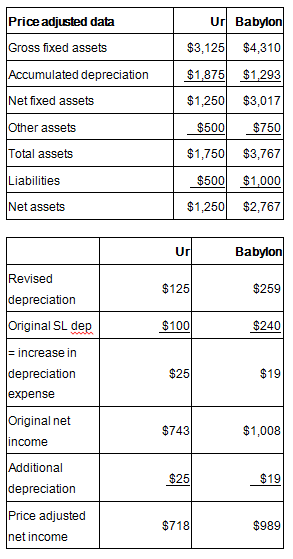

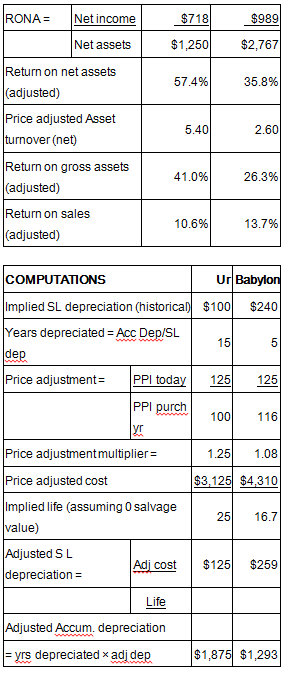

Mesopotamian Materials Inc. (MMI) has two decentralized divisions (Ur and Babylon) that have decision making responsibility over the amount of resources invested in their divisions. Recent financial extracts for both divisions are presented below:

*Net income is after tax but before interest

MMI's weighted average cost of capital (WACC) is 11.5%. The MMI measures division performance based on the book value of net assets. The producer price index 15 years ago was 100, 116 five years ago, and currently is 125.

Which is true, when fixed asset costs are adjusted upward for inflation?

A. Babylon's RONA is 35.8%

B. Babylon's RONA is 26.3%

C. Ur's depreciation expense increases by $19 more than Babylon's

D. Babylon's price adjustment multiplier is 1.16

E. None of the above

A. Babylon's RONA is 35.8%

You might also like to view...

At the beginning of the year, your company borrows $20,000 by signing a four-year promissory note that states an annual interest rate of 8% plus principal repayments of $5,000 each year. Interest is paid at the end of the second and fourth quarters, whereas principal payments are due at the end of each year. How does this new promissory note affect the current and non-current liability amounts reported on the classified balance sheet prepared at the end of the first quarter?

A. Increase current liabilities by $1,600; increase non-current liabilities by $20,000. B. Increase current liabilities by $5,400; increase non-current liabilities by $20,000. C. Increase current liabilities by $5,400; increase non-current liabilities by $15,000. D. Increase current liabilities by $400; increase non-current liabilities by $20,000.

In the budgeting process, business, team, and individual goals are established. Human behavior problems can arise in all of the following cases except ________

a. the budget goals of the business conflict with the objectives of employees (goal conflict) b. the budget goal is very easy to achieve (too loose) c. the budget goal is void of direction that includes responsibility centers d. the budget goal is unachievable (too tight)

Spontaneously generated funds are generally defined as follows:

A. Assets required per dollar of sales. B. A forecasting approach in which the forecasted percentage of sales for each item is held constant. C. Funds that a firm must raise externally through borrowing or by selling new common or preferred stock. D. Funds that arise out of normal business operations from its suppliers, employees, and the government, and they include spontaneous increases in accounts payable and accruals. E. The amount of cash raised in a given year minus the amount of cash needed to finance the additional capital expenditures and working capital needed to support the firm's growth.

A loss incurred by a corporation

A. must be carried forward unless the company has had 2 loss years in a row. B. can be carried back 2 years, then carried forward up to 20 years following the loss. C. can be carried back 5 years and forward 3 years. D. cannot be used to reduce taxes in other years except with special permission from the IRS. E. can be carried back 3 years or forward 10 years, whichever is more advantageous to the firm.