When interest rates fall, bond values rise.

Answer the following statement true (T) or false (F)

True

You might also like to view...

If all existing firms and all potential firms have the same cost curves, there are no inputs in limited quantities, and the market is characterized by free entry and exit, then the long-run market supply curve

a. is horizontal and equal to the minimum of long-run marginal cost for each firm. b. must slope downward. c. must slope upward. d. is horizontal and equal to the minimum of long-run average cost for each firm.

If the U.S. dollar depreciates, in the long run the United States should experience a

A. Larger deficit in the U.S. current account. B. Lower inflation rate. C. Smaller deficit in the U.S. trade balance. D. Larger deficit in the U.S. capital account.

If a firm's total revenue is less than its variable cost when the firm produces the level of output at which price equals marginal cost, then the firm should:

A. shut down. B. not change its level of output even if it's earning an economic loss in the short run. C. produce more so that its total revenue increases. D. purchase more fixed factors of production.

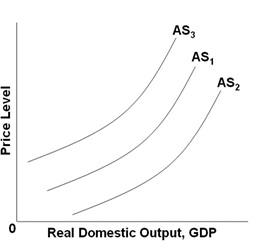

Which of the following factors will shift AS1 to AS2?

Refer to the graph above.

A. An increase in real interest rates

B. A decrease in business subsidies

C. An increase in input prices

D. A decrease in business taxes