Jill and Daniel graduate from college in the same year in economics and physics respectively and start looking for jobs. They are competitors in the job market

Indicate whether the statement is true or false

F

You might also like to view...

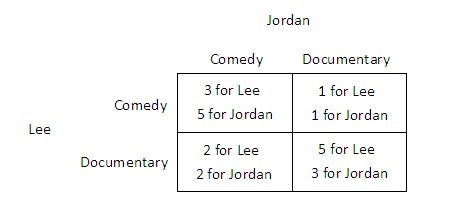

Suppose Jordan and Lee are trying to decide what to do on a Friday. Jordan would prefer to see a comedy while Lee would prefer to see a documentary. One documentary and one comedy are showing at the local cinema. The payoffs they receive from seeing the films either together or separately are shown in the payoff matrix below. Both Jordan and Lee know the information contained in the payoff matrix. They purchase their tickets simultaneously, ignorant of the other's choice.  Which of the following statements is true?

Which of the following statements is true?

A. For Lee, seeing a documentary is a dominant strategy. B. Lee does not have a dominant strategy. C. Lee's dominant strategy depends on Jordan's choice. D. For Lee, seeing a comedy is a dominant strategy.

The firms in a perfectly competitive are making an economic profit when new firms enter. The entry shifts the short-run market supply curve ________, the market price ________, and each firm's economic profit ________

A) leftward; rises; decreases B) rightward; rises; increases C) rightward; falls; decreases D) leftward; falls; decreases

Which of the following policies could lead to a deadweight loss?

A) price ceilings. B) price floors. C) policies prohibiting human cloning. D) all of the above E) A and B only

Fresh Flour makes baking flour and sells its flour in 4 pound sacks or bags. The managers of Fresh Flour are considering whether the firm should make or buy the flour sacks. To make the sacks, Fresh Flour needs a $500,000 piece of equipment. Using this equipment, Fresh Flour can make a flour sack for $0.01 and, for simplicity, ignore taxes and assume that the $0.01 cost includes depreciation and

all other costs. Fresh Flour would finance the $500,000 investment using its own funds and, if it purchased the flour sacks from another firm, it would pay $0.19 a flour sack. The life span of the equipment is 10 years and it has no salvage value at the end of the ten years. The discount rate is 6 percent. How many flour sacks does Fresh Flour need each year in order for the net present value to be positive? A) 259,666 B) 377,416 C) 352,589 D) 412,369