Why is deflation, combined with a recessionary gap, and a nominal interest rate that cannot be reduced a monetary policymaker's nightmare?

What will be an ideal response?

If we consider this piece-by-piece the answer becomes clear. Recall that when current output is below potential output, so that there is a recessionary output gap, current inflation is below expected inflation and expected inflation falls. In this case, that drives deflation down further. In this case however, if nominal interest rates are already at the ELB they cannot be reduced. Now compound the problem with deflation. If nominal interest rates hit their effective lower bound and deflation occurs, the real interest rate is rising. The increasing real interest rates could further decrease aggregate demand making the recessionary gap worse and potentially leading to a deflationary spiral. As this happens monetary policymakers are left watching without the ability to lower nominal interest rates.

You might also like to view...

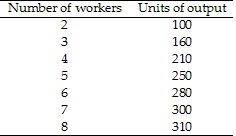

Refer to Table 10.1. If the price of output is $2 per unit and we observe the firm hiring six workers, if the firm is maximizing profit, the wage rate must be between ________ and ________.

Refer to Table 10.1. If the price of output is $2 per unit and we observe the firm hiring six workers, if the firm is maximizing profit, the wage rate must be between ________ and ________.

A. $20; $40 B. $30; $50 C. $40; $60 D. $500; $600

A monopoly earns total revenue of $20,000 when it sells 200 units of output and total revenue of $22,000 when it sells 240 units of output. Thus, the marginal revenue of the 240th unit is $91.67.

Answer the following statement true (T) or false (F)

In practice, the actual size of the ________ is about 2.

A. saving function B. MPS C. MPC D. multiplier

High rates of unemployment:

A. Indicate that society is not using a large portion of the talent and skills of its people B. Are associated with higher price levels C. Always correspond to a decrease in nominal GDP D. Do not affect an economy's output of goods and services