Why does exchange rate overshooting occur?

What will be an ideal response?

POSSIBLE RESPONSE: Exchange rate overshooting occurs because product prices are assumed to be slow to adjust (sticky) in the short run and fully adjustable (flexible) in the long run. A considerable amount of time must pass for an increase in money supply to lead to an increase in domestic prices. Thus, purchasing power parity is more realistically assumed to hold in the long run but not in the short run. Because prices are sticky at first, the increase in money supply drives down domestic interest rates. This shift favors foreign currency assets, and the resulting capital outflow results in immediate large depreciation of the domestic currency. As prices adjust in the long run, the domestic currency reverts back to its new long-run equilibrium.

You might also like to view...

Smart phones are becoming less expensive as new technology reduces the cost of production. In a supply and demand model, explain the effects of the technological innovations and their effect on the quantity of smart phones

What will be an ideal response?

Refer to the figure above. If A forms a customs union with C, A's welfare will change by

A) $a + $e B) $a + $b + $c + $d + $e C) $a + $e - $b - $c - $d D) $a + $e - $h - $i - $j

During the first phase of regulation in the United States (from 1887 to the Great Depression), the primary target of regulation was the:

A. labor unions. B. communication industry. C. food and drug industries. D. railroads.

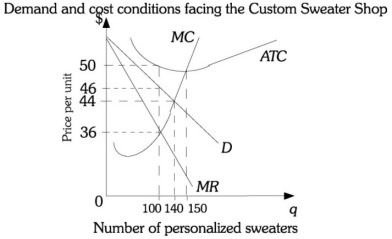

Refer to the information provided in Figure 15.5 below to answer the question(s) that follow.  Figure 15.5 Refer to Figure 15.5. Assume the Custom Sweater Shop has fixed costs of $275 and is a monopolistically competitive firm. If this firm is attempting to maximize profits, the firm's profit is

Figure 15.5 Refer to Figure 15.5. Assume the Custom Sweater Shop has fixed costs of $275 and is a monopolistically competitive firm. If this firm is attempting to maximize profits, the firm's profit is

A. -$275. B. -$100. C. -$75. D. $0.