Assume a hypothetical case where an industry begins as perfectly competitive and then becomes a monopoly. As a result of this change

A) price will be higher, output will be lower, and the deadweight loss will be eliminated.

B) consumer surplus will be smaller, producer surplus will be greater, and there will be a reduction in economic efficiency.

C) consumer surplus will be smaller and producer surplus will be greater. There will be a net increase in economic surplus.

D) price will be higher, consumer surplus will be greater, and output will be greater.

B

You might also like to view...

What are the different categories of risk preferences? Explain

What will be an ideal response?

The Stogie Shop, a cigar store in the mall, sells hand-rolled cigars for $10.00 and machine-made cigars for $2.50 each. What is the opportunity cost of buying a hand-rolled cigar?

A) $10.00 B) 4 machine-made cigars C) $2.50 D) one-quarter of a machine-made cigar

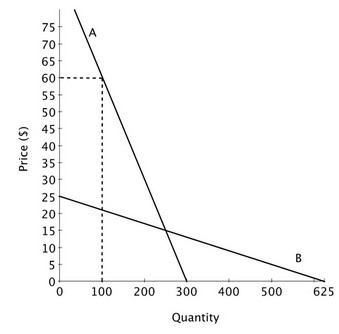

Suppose that a new drug has been approved to treat a life-threatening disease. The demand for that drug is shown on the accompanying graph. Prior to approval of this drug, the only treatment for this condition was any one of several non-prescription, or over-the-counter, pain relievers. The demand for one brand of the several non-prescription pain relievers is also shown on the graph. At a price of $15 (the price at which the two demand curves intersect), the price elasticity of demand for the new drug is ________ the price elasticity of demand for the over-the-counter pain reliever.

At a price of $15 (the price at which the two demand curves intersect), the price elasticity of demand for the new drug is ________ the price elasticity of demand for the over-the-counter pain reliever.

A. greater than B. the same as C. the reciprocal of D. less than

New classical economists believe that

A. wage and price controls are needed to help control inflation. B. governmental intervention is destabilizing and harmful to the economy. C. the federal government has abdicated its responsibility to promote a non-inflationary full employment economy. D. antitrust laws should be toughened in order to restrain inflation.