The firm's cost of a new issue of common stock is ________.

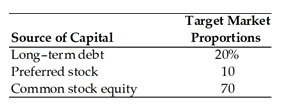

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

A) 7 percent

B) 9.08 percent

C) 14.2 percent

D) 13.4 percent

C) 14.2 percent

You might also like to view...

Fabrick Company's quality cost report is to be based on the following data: Lost sales due to poor quality$78,000Quality data gathering, analysis, and reporting$23,000Net cost of spoilage$88,000Re-entering data because of keying errors$98,000Test and inspection of in-process goods$24,000Final product testing and inspection$78,000Statistical process control activities$49,000Returns arising from quality problems$16,000Downtime caused by quality problems$26,000? ?What would be the total prevention cost appearing on the quality cost report?

A. $101,000 B. $96,000 C. $73,000 D. $72,000

An asset having a four-year service life and a salvage value of $5,000 was acquired for $45,000 cash on January 2 . The depreciation expense for the second year, December 31, will be:

a. $5,000, under the straight-line method. b. $11,250, under the declining-balance method. c. $14,000, under the sum-of-the-years'-digits method. d. $11,250, under the straight-line method. e. $16,000, under the sum-of-the-years'-digits method.

Maruska Corporation has provided the following data concerning its only product: Selling price$180per unitCurrent sales 29,800unitsBreak-even sales 25,032unitsWhat is the margin of safety in dollars?

A. $5,364,000 B. $3,576,000 C. $4,505,760 D. $858,240

Which of the following terms is INCORRECTLY paired with its description?

a. a certificate of origin: indicates the company which manufactured or processed the goods in a particular shipment b. a bill of lading: delineates the terms of the contract between the shipper and the transportation company c. a commercial invoice: a customs declaration document d. shipper’s export declaration: a document showing the value, weight, destination, and other features of export shipments