Cantor Products sells a product for $75. Variable costs per unit are $50, and monthly fixed costs are $75,000. Answer the following questions:a. What is the break-even point in units?b. What unit sales would be required to earn a target profit of $200,000?c. Assume they achieve the level of sales required in part b, what is the degree of operating leverage?d. If sales decrease by 30% from that level, by what percentage will profits decrease?

What will be an ideal response?

a. 3,000 units = $75,000/($75 - $50)

b. 11,000 units = ($75,000 + $200,000)/($75 - $50)

c. 1.375 = [11,000 × ($75 - $50)]/$200,000

d. 41.25% = 30% × 1.375

Break-even units = Fixed costs/Unit contribution margin. Target units = (Fixed costs + Target profit)/Unit contribution margin. Degree of operating leverage = Contribution margin/Profit. Change in revenue × Degree of operating leverage = Change in profit.

You might also like to view...

Acquisition cost is also referred to as: ________________

Fill in the blank(s) with correct word

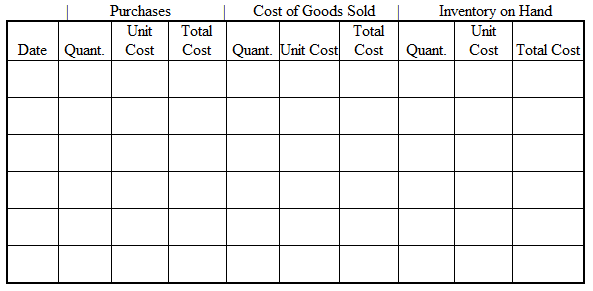

Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.)

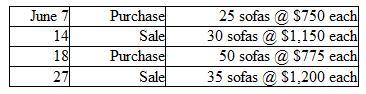

Third Avenue Furniture began June with merchandise inventory of 45 sofas that cost a total of $31,500. During the month, the company purchased and sold merchandise on account as follows:

The objective-and-task method uses past sales and communication activities to determine the present communication budget.

Answer the following statement true (T) or false (F)

Rights are sometimes described as "trumps" that override the collective will. Rights function to protect certain interests that are more important and central in human well-being than the mere happiness of others.

Answer the following statement true (T) or false (F)