If a uniform abatement standard is used by the regulatory authority, what would be the dollar values of TAC and MAC for each source?

Suppose two point sources are discharging phosphorus into Wisconsin’sFox River and face the following abatement costs for this pollutant:

Point Source 1: TAC1 = 500 + 0.35(A1)2

MAC1 = 0.7A1

Point Source 2: TAC2 = 750 + 1.05(A2)2

MAC2 = 2.1A2,

where A1 and A2 represent the abatement of phosphorus effluents in pounds by Source 1 and Source 2, respectively, and TAC and MAC are measured in hundreds of dollars.

Assume that the state environmental authority has set the total maximum daily load (TMDL) for the Fox River. To achieve this limit, 40 pounds of phosphorus must be abated across the two point sources. Use this information to answer the following questions.

Based on a uniform abatement standard, A1 = A2 = 20 lbs. Therefore,

MAC1 = 0.7(20) = $14 hundred or $1,400

TAC1= 500 + 0.35(20)2 = $640 hundred, or $64,000

MAC2 = 2.1(20) = $42 hundred or $4,200

TAC2 = 750 + 1.05(20)2 = $1,170 hundred, or $117,000.

You might also like to view...

Sarah went to a store that sells used goods to buy a camera. She was looking at different models when the store manager asked her about the maximum price that she would pay

Because it was impossible to know the quality of the cameras, Sarah lowered her willingness to pay to $200, although she values a used camera of good quality at $300. If the seller values a camera of good quality at $250, what is most likely to happen in this case?

A markup of price over marginal cost is inconsistent with free entry and zero profit

a. True b. False Indicate whether the statement is true or false

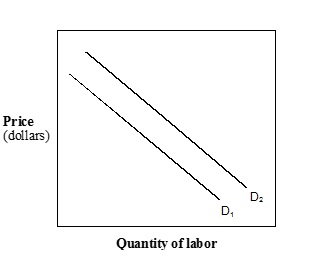

Exhibit 11- 7 Demand for labor curves

?

A. Increase in the demand for the product. B. Decrease in wages. C. Decrease in price of product. D. Decrease in demand for the product.

Suppose an income tax is imposed that takes $1,000 from someone with an income of $20,000; $4,000 from someone with an income of $30,000; and $12,000 from someone with an income of $80,000. This tax would be classified as

A. a flat tax. B. proportional. C. regressive. D. progressive.