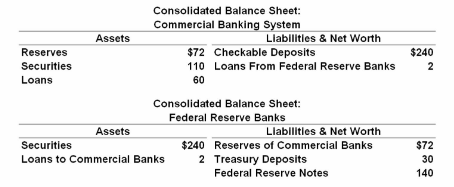

Refer to the given balance sheets and assume the reserve ratio is 25 percent. Suppose the Federal Reserve Banks sell $2 in securities directly to the commercial banks. As a result of this transaction, the supply of money:

A. will decrease by $2, but the money-creating potential of the commercial banking system

will not be affected.

B. is not directly affected, but the money-creating potential of the commercial banking system

will decrease by $8.

C. will directly increase by $2 and the money-creating potential of the commercial banking

system will decrease by an additional $8.

D. will directly increase by $2 and the money-creating potential of the commercial banking

system will increase by an additional $8.

B. is not directly affected, but the money-creating potential of the commercial banking system

will decrease by $8.

You might also like to view...

If expectations are adaptive, how will the economy adjust to a new long-run equilibrium in response to contractionary monetary policy? Support your answer with a graph of the Phillips curve

What will be an ideal response?

What was not a significant cause of the Great Depression?

a. Bank failures b. Stock market crash c. Government fiscal and monetary policy d. Large increase in imports that took jobs away from American workers

Which of the following is a problem when comparing GDPs per capita between nations?

A. GDP per capita only measures income distribution. B. Fluctuations in exchange rates affect differences in GDP per capita. C. GDP per capita is subject to greater measurement errors for IACs compared to LDCs. D. GDP per capita is likely overstated in LDCs due to families producing goods and services outside of the pricing system.

The major similarity between monopolistic competition and perfect competition is

A) the shape of the demand curve. B) that both assume many buyers and sellers. C) price equals marginal revenue in each. D) both assume products are differentiated.