Two operationally similar companies, HD and LD, have identical amounts of assets, operating income (EBIT), tax rates, and business risk. Company HD, however, has a much higher debt ratio than LD. Company HD's basic earning power ratio (BEP) exceeds its cost of debt (rd). Which of the following statements is CORRECT?

a. Company HD has a higher times interest earned (TIE) ratio than Company LD.

b. Company HD has a higher return on equity (ROE) than Company LD, and its risk, as measured by the standard deviation of ROE, is also higher than LD's.

c. The two companies have the same ROE.

d. Company HD's ROE would be higher if it had no debt.

e. Company HD has a higher return on assets (ROA) than Company LD.

b

You might also like to view...

Beth likes to volunteer at a local food bank. Because she once worked at a large supermarket and saw lots of food that had not been purchased, she arranged for a local store to give unsold items to the food bank. Beth was engaged in ________

A) lateral cycling B) divestment cycling C) freecycling D) underground cycling

A(n) _____ is one piece of information about an entity, such as the last name or first name of a student, or the student's street address.

Fill in the blank(s) with the appropriate word(s).

A superstore is a storeless retailer serving a specific clientele who are entitled to buy from a list of retailers that have agreed to give discounts in return for membership

Indicate whether the statement is true or false

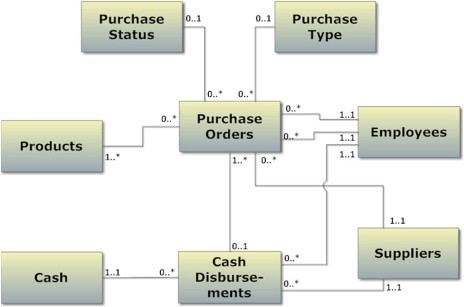

Refer to the following UML class diagram to answer the question below about the relational database based on this model. The association between Purchase Orders and Products would be implemented with a linking table.

The association between Purchase Orders and Products would be implemented with a linking table.

Answer the following statement true (T) or false (F)