Refer to Scenario 19.3 below to answer the question(s) that follow. SCENARIO 19.3: Suppose demand for widgets is given by the equation P = 20 - 0.5Q. Originally, the price of the good is $10 per unit. When a tax of $2 per unit is imposed, the price of the good rises to $12 per unit.Refer to Scenario 19.3. What is the total burden of the tax?

A. $4

B. $36

C. $64

D. $100

Answer: B

You might also like to view...

Suppose the money market has an equilibrium interest rate of 10 percent. If the actual interest is 8 percent, which of the following occurs to bring the money market back to equilibrium?

A) People buy bonds, the price of bonds rises and the interest rate rises. B) People buy bonds, the price of bonds falls and the interest rate rises. C) People sell bonds, the price of bonds rises and the interest rate rises. D) People sell bonds, the price of bonds falls and the interest rate rises.

The GDP deflator: a. includes fewer goods and services than the CPI

b. generally rises substantially faster than the CPI during inflationary conditions. c. ignores investment goods and goods produced by the government. d. is the broadest generally reported measure of inflation.

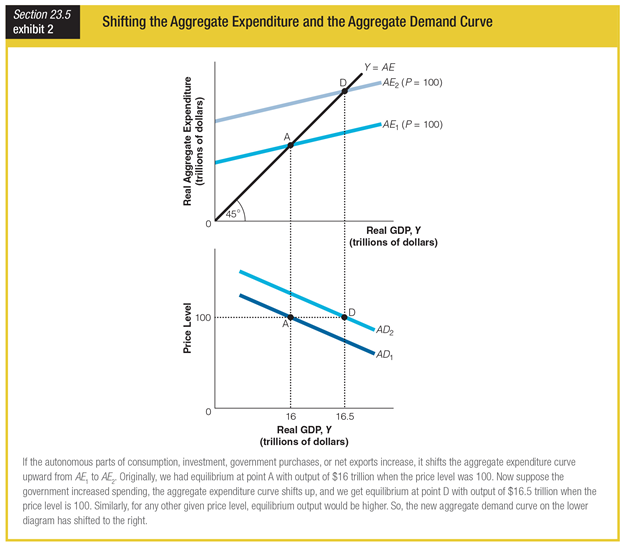

Which of the following is likeliest to have increased between points A and D?

a. price indices

b. interest rates

c. government spending

d. net imports

Economists John Cogan, Glenn Hubbard, and Daniel Kessler have estimated that repealing the tax preference for employer-provided health insurance would

A) significantly reduce the effectiveness of the health care received by those enrolled in these programs. B) increase overall spending on health care as consumers would have to pay a higher price for medical services. C) drive up prices for health care coverage since insurance reimbursements to doctors would be reduced. D) reduce spending by people enrolled in these programs by 33 percent.