Which type of product does Delgado manufacture?

A) industrial

B) convenience

C) specialty

D) shopping

E) unsought

C

You might also like to view...

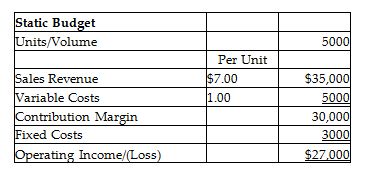

Infinity Clock Company prepared the following static budget for the year:

If a flexible budget is prepared at a volume of 7800 units, calculate the amount of operating income. The production level is within the relevant range.

A) $43,800

B) $27,000

C) $7800

D) $3000

A bank robbery has occurred, and the banker's association has offered a $1,000 reward for information leading to the arrest and conviction of the robber. Several people are claiming to be entitled to the money. Which of them is eligible?

a. The employees of the bank. b. An on-duty sheriff's deputy in the county where the arrest occurred. c. An off-duty deputy sheriff from a county other than the one where the arrest occurred. d. None of these are eligible.

Gerhardt is the president of the Pacer Bicycle Company. He also serves as a director of the Flexible Tire Company. It occurs to Gerhardt that both companies could benefit from a contract in which Flexible agrees to supply Pacer with tires for its bicycles. If Gerhardt wishes to negotiate a contract between Pacer and Flexible, which of the following is correct?

a. The contract will be void as a conflict of interest. b. Under the RMBCA, the contract is permitted if it is fair and reasonable to both corporations, or Gerhardt fully discloses all information relating to the transaction and the contract is approved by either the board of disinterested directors or the shareholders. c. The contract is a clear conflict of interest and will be avoidable by either company even with disclosure. d. Both the contract will be void as a conflict of interest and the contract is a clear conflict of interest and will be avoidable by either company even with disclosure.

Calculate the payback period (PP) for the cash flows provided in the table below. Note: The negative cash flow for year 0 is the initial investment for the project

Year Cash Flow 0 -$80,000 1 $32,000 2 $32,000 3 $32,000 A) 3 years B) 2.50 years C) 1.75 years D) 1 year