If future price changes were perfectly anticipated by both borrowers and lenders, then _____

a. the expected real interest rate would be higher than the actual rate

b. the expected real interest rate would lower than the actual rate

c. the real interest rate in the future would decrease by the amount of the price increase

d. the real interest rate in the future would increase by the amount of the price increase

e. the real interest rate in the future would remain unchanged

e

You might also like to view...

"The duopolists' dilemma occurs when firms in a duopoly coordinate their decisions to achieve the best possible outcome." Is the previous statement correct or incorrect? Why?

What will be an ideal response?

The stagflation in the United States during the 1974-1975 period can be attributed to

a. increases in real GDP due to high levels of defense spending. b. tight monetary and fiscal policies of the Nixon-Ford administrations. c. rapid increases in petroleum prices, poor harvests, and the removal of wage and price controls. d. budget deficits by the federal government and increasing trade deficits by the United States.

Horizontal equity refers to a tax system in which individuals with similar incomes pay similar taxes

a. True b. False Indicate whether the statement is true or false

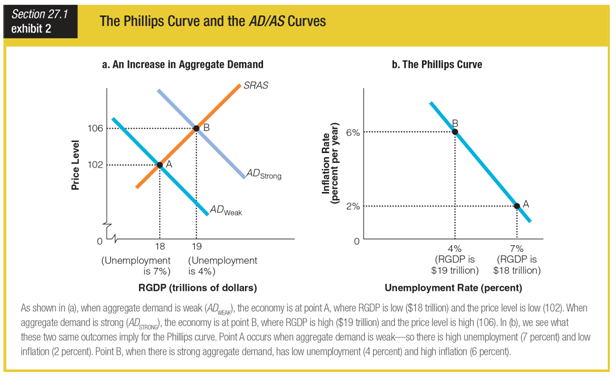

Based on the graphs for an increase in aggregate demand and the Phillips curve, we can see that when aggregate demand is weak, ______.

a. RGDP is high

b. unemployment is low

c. inflation is low

d. inflation is high