A regressive tax:

a. is designed to take a larger percentage of higher incomes as compared to lower incomes

b. is designed in such a way that as a person's income rises, the amount of tax as a proportion of income rises.

c. takes a greater proportion of the income of lower-income groups than of higher-income groups.

d. is considered to be the most equitable type of tax.

c

You might also like to view...

In the long run a company that produces and sells organic tofu incurs total costs of $1,200 when output is 1,200 units and $1,650 when output is 1,400 units. The tofu company exhibits

a. diseconomies of scale because total cost is rising as output rises. b. diseconomies of scale because average total cost is rising as output rises. c. economies of scale because total cost is rising as output rises. d. economies of scale because average total cost is falling as output rises.

Microeconomics is the study of

a) the economy as a whole. b) individual components in the economy. c) individual economic behaviour. d) both (b) and (c).

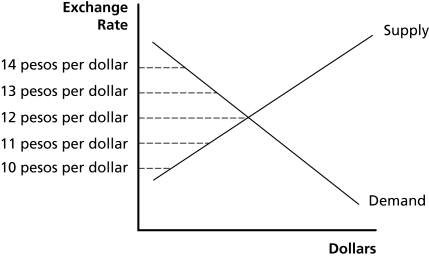

Referring to Figure 18.2, U.S. goods will become more expensive in Mexico if the exchange rate goes from ________ to ________ pesos to the dollar.

Referring to Figure 18.2, U.S. goods will become more expensive in Mexico if the exchange rate goes from ________ to ________ pesos to the dollar.

A. 12; 11 B. 12; 13 C. 13; 11 D. 14; 10

Describe the market effects of a carbon tax.

What will be an ideal response?