Visit the U.S. Internal Revenue Service website at www.irs.gov and answer the following questions about depreciation and MACRS by consulting Publication 946, How to Depreciate Property.

(a) What is the definition of depreciation according to the IRS?

(b) What is the description of the term salvage value?

(c) What are the two depreciation systems within MACRS, and what are the major differences between them?

(d) What are the properties listed that cannot be depreciated under MACRS?

(e) When does depreciation begin and end?

( f ) What is a Section 179 Deduction?

Quoting Publication 946, 2015 version:

(a) “Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. It is an allowance for the wear and tear, deterioration, or obsolescence of the property.”

(b) “An estimated value of property at the end of its useful life. Not used under

MACRS.”

(c) General Depreciation System (GDS) and Alternative Depreciation System (ADS).

The recovery period and method of depreciation are the primary differences.

(d) The following cannot be MACRS depreciated: intangible property; films and video

tapes and recordings; certain property acquired in a nontaxable transfer; and property placed into service before 1987.

(e) Depreciation begins when property is placed into service, when it is ready and available for a specific use, whether in a business activity, an income-producing activity, a tax-exempt activity, or a personal activity. Even if not using the property, it is in service when it is ready and available for its specific use.

Depreciation ends when property is retired from service, even if its cost or other basis is not fully recovered.

(f) A taxpayer can elect to recover all or part of the cost of certain qualifying property, up to a limit, by deducting it in the year the property is placed in service. The taxpayer can elect the Section 179 Deduction instead of recovering the cost through depreciation deductions.

You might also like to view...

You have $200 000 to invest, and you have decided to purchase bonds that will mature in six years. You have narrowed your choices to two types of bonds. The first class pays 8.75 percent annual interest. The second class pays 5.4 percent annual interest but is tax-free, both federal and state. Your income bracket is such that your highest income tax rate is 31 percent federal and the state income tax is 9 percent. Which is the better investment for you at this time? Assume that all conditions remain unchanged for the six-year period.

What will be an ideal response?

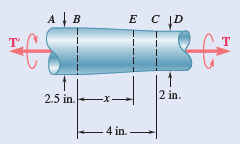

PROBLEM 3.109 The magnitude of the torque T applied to the tapered shaft of Prob. 3.108 is slowly increased. Determine (a) the largest torque that may be applied to the shaft, (b) the length of portion BE that remains fully elastic. PROBLEM 3.108 A shaft of mild steel is machined to the shape shown and then twisted by torques of magnitude 40 kip · in. Assuming the steel to be elastoplastic with ?Y = 21 ksi, determine (a) the thickness of the plastic zone in portion CD of the shaft, (b) the length of portion BE that remains fully elastic.

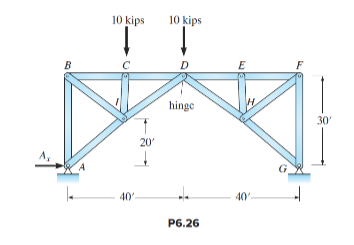

Compute the horizontal reaction at A of the arch in Figure P6.26.

____ are not usually permitted on the hinged side of the door but are required to be located on the strike side.

What will be an ideal response?