Following the rate reductions of the Tax Cuts and Jobs Act, it is not possible for after-tax cash flow from a taxable corporation to exceed after-tax cash flow from a passthrough entity.

Answer the following statement true (T) or false (F)

False

You might also like to view...

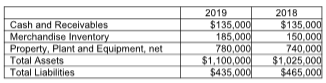

For the vertical analysis, what is the percentage of total liabilities for December 31, 2018? (Round your answer to two decimal places.)

For the vertical analysis, what is the percentage of total liabilities for December 31, 2018? (Round your

answer to two decimal places.)Reliable Moving Company reported the following amounts on its balance sheet as of December 31,

2019 and December 31, 2018:

A) 100.00%

B) 39.55%

C) 29.03%

D) 45.37%

Aaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $750,000 and $550,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 18,000 hours and 7000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.)

A) $107.14 per machine hour B) $30.56 per labor hour C) $1.36 per labor hour D) $78.57 per machine hour

Briefly discuss the significant changes in entrepreneurship from the 1960s to the 1990s.

What will be an ideal response?

An example of a retailer's regularly reviewing operations is the _____

a. appeal to a prime consumer market b. use of a one-price policy c. development of realistic sales and profit goals d. ongoing analysis of sales and costs by product category