Economists play an important role in the complex debates over tax policy by

a. identifying efficiency as the most important goal of tax policy.

b. identifying equity as the most important goal of tax policy.

c. shedding light on the tradeoff between efficiency and equity in tax policy.

d. None of the above is correct.

c

You might also like to view...

What is the shape of a monopolist's demand curve and marginal revenue curve?

What will be an ideal response?

Which of the following is not true about income quintiles?

a. Only one in seven households in the bottom quintile has anybody working full time b. Only one in three households in the top quintile has anybody working at all c. A primary contributor to the smaller share of income going to the bottom quintile has been the growth of single-parent households d. Three out of four households in the top quintile have two or more working e. A primary contributor to the larger share of income going to the top quintile has been the growth of two-earner households

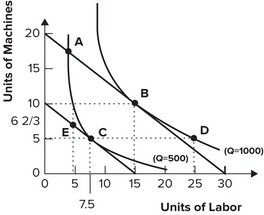

Refer to the graph shown. If labor costs $10 per unit and machines cost $15 per unit, the economically efficient cost of producing 1,000 units of output is:

A. $100. B. $300. C. $150. D. impossible to determine using the information given.

An example of a microeconomic decision is a situation in which

A. a government contemplates buying foreign currencies in an effort to influence exchange rates and the country's demand for goods and services. B. a firm evaluates how much to reduce the price of its product in an effort to influence sales and boost its profits. C. a central bank considers how much to increase the money supply during the coming month in an effort to constrain the rate of inflation. D. Congress and the president seek to reach a compromise on how much to increase government spending in an effort to influence national expenditures.