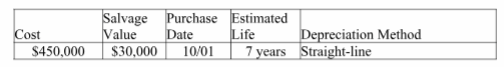

Calculate the depreciation expense for the asset in Year 1 and Year 2 for the year ended December 31.

A company's property records revealed the following information about one of its plant assets:

Year 1 [($450,000 — $30,000)/7] *3/12 = $15,000

Year 2 ($450,000 — $30,000)/7 = $60,000

You might also like to view...

Which of the following exemplifies a pure competitive market?

A) a market where many buyers and sellers trade over a range of prices rather than a single market price B) a market where a single firm controls the larger fraction of the market share C) a market where a few powerful firms control the larger fraction of the market share D) a market characterized by only a few large sellers E) a market where many buyers and sellers trade in a uniform commodity

Which of the following activities are likely to attract online publicity?

A) promotion of members in your organization B) television appearances or book tours C) lengthy, well-written product announcements D) major events such as concerts broadcast online

Fundamental analysis looks at which of the following?

A) Future earnings B) Dividends C) Expected levels of interest rates D) The firm's risk E) All of the above

Radical innovation refers to a product modification that allows improved performance and benefits without changing either consumption patterns or behavior

Indicate whether the statement is true or false