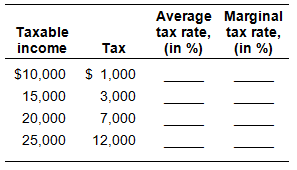

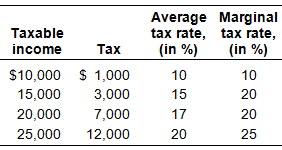

Given the following information on the tax paid for different levels of taxable income, fill in the average and the marginal tax rates for each income level. Also explain how to calculate the average tax rate and the marginal tax rate. Is this tax

progressive?

To find the average tax rate, divide the tax by the taxable income. To find the marginal tax rate, divide the change in the tax by the change in income. Note that the first marginal tax rate will equal the average rate. The tax rate is progressive; the marginal tax rate is increasing.

You might also like to view...

A downward-sloping demand curve for Korean won in terms of Canadian dollars indicates that the higher the dollar price of Korean won, the more won will be demanded

a. True b. False Indicate whether the statement is true or false

Suppose each of the following news items appears on the evening news. Which one would most likely cause consumption spending to increase?

a. "Layoffs reach record high" b. "Government to increase taxes with the start of the next quarter" c. "Stock market drops 10%" d. "Government to issue tax rebates at the end of next month" e. "Bankruptcies increase 20% over the last six months"

A monopoly firm is different from a perfectly competitive firm in that

A. there are many substitutes for the monopolist's product, whereas there are no close substitutes for the perfectly competitive firm's product. B. the monopolist's demand curve is perfectly inelastic, whereas the perfectly competitive firm's demand curve is perfectly elastic. C. the monopolist can influence price in the market, whereas the perfectly competitive firm is a price taker. D. All of these choices are true.

The resources that firms use in? production, including? land, buildings, and? equipment, are called

A. Factors B. Factor markets include all the resources firms use in their production C. Capital, land, buildings D. To produce out put