A system in which power plants buy and sell the right to pollute in the form of emission credits is known as:

A. direct regulation.

B. a voluntary program.

C. a market incentive program.

D. a tax incentive program.

Answer: C

You might also like to view...

According to the total revenue test, a price cut increases total revenue if demand is

A) inelastic. B) perfectly inelastic. C) elastic. D) unit elastic.

Price can be written as P = 155 - Q. (A) TR is price multiplied by quantity for TR = P × Q = 155 × Q - (0.25) × Q 2 . Marginal revenue is MR = 155 - 2 × Q d . Marginal costs are MC = 110 - 0.5 × Q. MC = MB for monopolist Q* = 30, P* = 125, TR = P × Q = 125 × 30 = 3,750 Profits = TR - TC = 3,750 - [110 × 30 - (0.25) 30 2 ] = 675. (B) AC = TC/Q = 110 + (0.25) × Q. AC = D if the government intervenes, 110 - (0.25) × Q = 155 - Q so Q* = 60 and P* = 95 TR = P × Q = 60 × 95 = 5,700 Profits = TR - TC = 5,700 - [110 × 60 - (0.25) × 60 2 ] = 0 (C) Now the monopolist produces at perfectly competitive market quantity, S = D so MC = D thus 110 + (0.5) × Q = 155 - Q Q* = 90 and P* = 65 TR = P × Q = 65 × 90 = 5,850 Profits = TR - TC = 5,850 - [110 × 90 - (0.25) × 90 2 ] = - 2,025

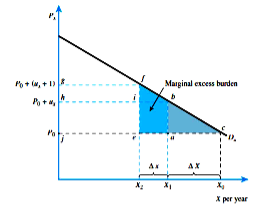

(A) If the original price of the good was $10 and a $4 tax was imposed, what is the tax

income? What is the excess burden?

(B) How much marginal excess burden will be created if an additional dollar of tax is levied?

(C) How much additional tax is collected?

According to Kuznets (1954), competition will

(a) unfairly destroy leading industries and impede overall economic growth across industries. (b) require government intervention. (c) push efficient industries into leadership roles and pull the backward and forward industrial links to these leaders with them. (d) contract consumer market opportunities.

Horizontal equity is a difficult concept to implement because

a. it is difficult to determine how unequally unequals should be treated. b. it is difficult to measure ability to pay. c. it is difficult to determine which people are equally situated. d. people object to the use of absolute tax liability instead of percentage of income.